The world of insurance can feel like a labyrinth, especially when you're trying to figure out how to keep your eyes healthy without breaking the bank. You might have excellent medical coverage, but then you get that bill for new glasses or an annual eye exam and wonder, "Wait, isn't this covered?" That's often where what is vision insurance and how does it work comes into the picture, offering a distinct safety net for your sight-related expenses.

It's not just about correcting blurry vision; it's about safeguarding one of your most vital senses. But unlike traditional health insurance, vision plans operate on their own set of rules, benefits, and coverage models. Understanding these nuances is key to making informed decisions for your eye health and your wallet.

At a Glance: Vision Insurance Essentials

- Distinct Coverage: Vision insurance is separate from medical insurance. It covers routine eye care like exams and eyewear, not medical conditions or injuries.

- Defined Benefits: Instead of percentage-based payouts, plans typically offer fixed copays for services, dollar allowances for products (like frames), and discounts on other costs.

- Routine Care Focused: Primarily covers one eye exam and one set of glasses/contacts annually or biannually.

- Network-Based: Using in-network providers often leads to lower out-of-pocket costs.

- Variety of Plans: From traditional benefits plans to discount programs, options exist for different needs and budgets.

Why Your Eyes Need More Than Just Medical Insurance

Let's clear up a common misconception right away: your standard health insurance plan, while crucial for overall well-being, usually doesn't cover your routine eye care needs. Think of it this way: medical insurance steps in for illnesses, injuries, and chronic conditions affecting your eyes—like glaucoma, cataracts, or infections. If you need surgery for a detached retina or treatment for pink eye, your health insurance is typically the one to call.

Vision insurance, on the other hand, is specifically designed for the preventative and corrective care that keeps your vision sharp. It’s for those regular check-ups, updating your prescription, and getting new glasses or contact lenses. It fills a crucial gap, helping you manage the ongoing costs associated with maintaining good vision.

Decoding the Dollars and Cents: How Vision Insurance Pays Out

Unlike medical insurance, where you often encounter deductibles, coinsurance, and out-of-pocket maximums before your plan pays a percentage, vision insurance tends to be more straightforward. It operates on a system of defined benefits that make your costs predictable.

- Copayments (Copays): This is a fixed, upfront amount you pay for a specific service, like your annual eye exam. For example, your plan might state a $10 or $20 copay for an eye exam, regardless of the optometrist's total fee.

- Allowances: For products like frames or contact lenses, your plan provides a capped dollar amount. If frames cost $150 and your allowance is $120, you pay the remaining $30. Any unused allowance doesn't typically roll over to the next year, making it a "use it or lose it" benefit. This approach helps control costs and ensures you get value from your plan within the benefit period.

- Discounts: After any allowances are applied, your plan might offer a percentage discount on the remaining cost of products or on optional add-ons. So, if your frames exceed your allowance, you might get 20% off the overage. Discounts can also extend to services not fully covered, like lens enhancements.

These structures mean you know much of your out-of-pocket expense ahead of time, which can be a significant advantage when budgeting for eye care.

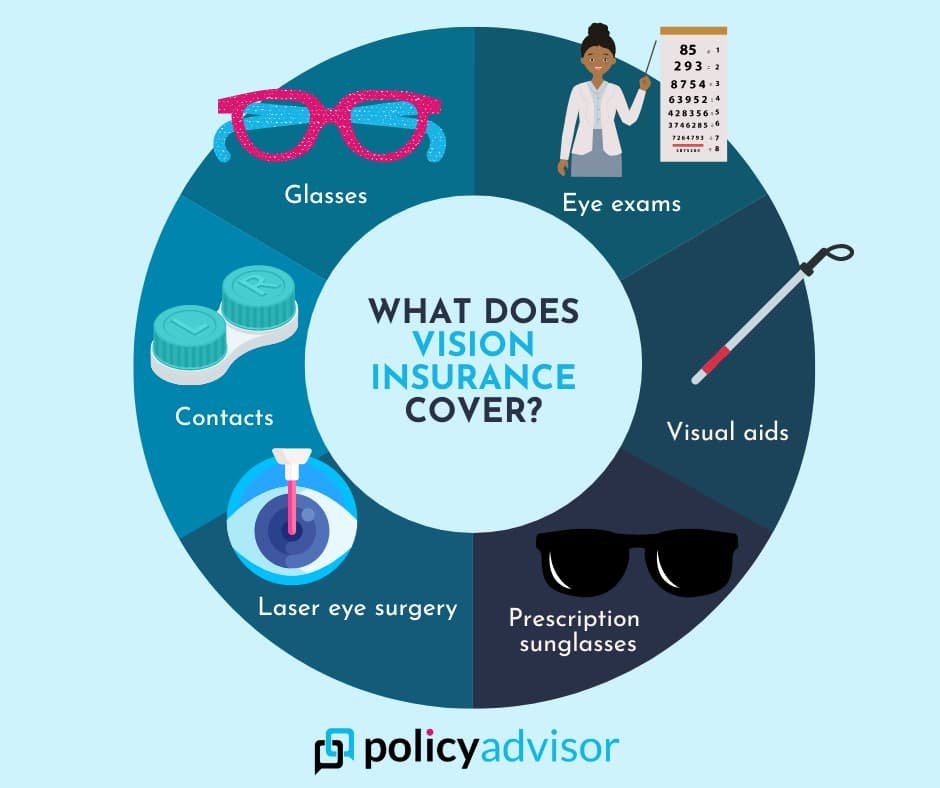

What Vision Insurance Typically Covers

When you invest in vision insurance, you're primarily buying coverage for the services and products most people need to see clearly.

Routine Eye Exams

Most vision plans cover one comprehensive eye exam per year or every two years. These aren't just about reading the eye chart; they're vital for assessing your overall eye health, detecting changes in your prescription, and screening for early signs of eye diseases or other health conditions. Often, you'll pay just a small copay for this service, or sometimes nothing at all. This proactive screening can catch issues before they become serious, highlighting the preventative value of these plans.

Prescription Eyewear: Glasses and Contacts

This is where many people see the most tangible benefit of vision insurance.

- Glasses (Frames & Lenses): Your plan will typically include an allowance for frames, letting you choose from a selection at participating providers. For lenses, standard single-vision, bifocal, or trifocal lenses are usually covered. However, if you need more specialized lenses, such as progressive lenses, or desire popular add-ons like anti-reflective coatings, scratch resistance, or blue light filters, these often fall outside standard coverage or require an additional out-of-pocket cost, sometimes with a discount applied.

- Contact Lenses: Similar to frames, you'll often receive an annual allowance for contact lenses. Many plans require you to choose between using your allowance for glasses or contact lenses within a given benefit period, not both. This means careful consideration of your preference is needed each year. If you opt for contacts, your allowance may cover a certain number of boxes or a specific dollar amount, with any excess paid out-of-pocket.

Potential Additional Benefits and Discounts

While the core coverage is routine exams and eyewear, some plans sweeten the deal with extra perks. You might find:

- Discounts on prescription sunglasses.

- Coverage or discounts on advanced lens options.

- Reduced rates for laser vision correction procedures like LASIK or PRK. These are typically not fully covered but a discount can still save you hundreds or even thousands of dollars.

Remember, these extra benefits vary significantly by plan, so it's always crucial to check the specific details of your policy.

What Vision Insurance Does NOT Cover

Just as important as knowing what's covered is understanding the exclusions. This is where the line between vision and medical insurance becomes critical.

Medical Eye Conditions and Treatments

This is the big one: vision insurance does not cover eye problems, diseases, injuries, or infections. If you develop glaucoma, cataracts, diabetic retinopathy, or experience an eye injury, your medical health insurance is the primary payer for diagnosis and treatment. Your vision plan is for healthy eyes that need routine maintenance and correction, not for medical interventions. This distinction is vital for understanding your financial responsibility.

Common Exclusions and Limitations

Beyond medical conditions, most vision plans have specific limitations:

- More Than One Eye Exam Per Year: While some plans may offer flexibility, annual or biannual exams are the norm.

- Non-Prescription Eyewear: Sunglasses without a prescription, reading glasses bought off the shelf, or novelty contacts are usually not covered.

- Costs Exceeding Allowances: As discussed, if your chosen frames or contact lenses go beyond your plan's allowance, you pay the difference.

- Major Medical Treatments or Surgery: This reinforces that surgical procedures or extensive medical treatments for eye conditions fall under health insurance.

- Prescription or Non-Prescription Medications: Eye drops, ointments, or oral medications for eye conditions are covered by your pharmacy benefits under your health plan, not vision insurance.

- Missed Appointments: Many providers charge a fee for missed appointments, which vision insurance will not cover.

To avoid surprises, it’s always best to carefully understand your vision insurance benefits and review your plan’s official documents, including any benefit summaries or exclusion lists.

Navigating the Landscape: Main Types of Vision Insurance Plans

The term "vision insurance" itself can be a bit broad, encompassing several different models that offer varying levels of coverage and flexibility. Knowing the differences can help you determine should you get vision insurance?

1. Vision Benefits Plans (Traditional Vision Insurance)

This is what most people picture when they think of vision insurance. These are standard insurance policies, frequently offered through employers or as part of a group benefits package.

- How They Work: They provide defined benefits—copays for exams, allowances for frames and contacts, and often discounts on other services. You pay a monthly or annual premium, and in return, the plan covers a portion of your costs.

- Provider Networks: These plans operate with specific provider networks. You'll typically get the best benefits by seeing an eye doctor who is "in-network." Some plans (PPOs) may offer partial coverage for out-of-network providers, while others (HMOs) may require you to stay strictly within their network for any coverage.

- Best For: Individuals who anticipate regular eye care needs, such as annual exams and frequent updates to their glasses or contact lens prescriptions. If you wear corrective lenses daily, this type of plan can offer significant savings.

2. Vision Discount Plans

It's crucial to understand that vision discount plans are not insurance. Instead, they are membership programs that provide access to discounted pricing at participating eye care providers and optical retailers.

- How They Work: You pay a low monthly or annual membership fee. In exchange, you receive a membership card that entitles you to a percentage off services and products (e.g., 20% off exams, 30% off frames, 10% off lenses). You pay the reduced rate directly to the provider at the time of service; there are no claims to file, no allowances, and no benefit year limitations like traditional insurance.

- Flexibility: These plans often have broader networks of participating providers and don't restrict your choices as much as some traditional insurance plans might.

- Best For: Those who prefer maximum flexibility, don't require frequent exams, or perhaps have infrequent vision needs. They can also be a good option for individuals managing eye care expenses directly or who find traditional premiums too high for their usage.

3. Employer-Sponsored Vision Plans

By far the most common type, these plans are offered by employers to their employees, often alongside health and dental benefits.

- How They Work: Employers typically subsidize a portion of the premiums, making them more affordable than individual plans. The specific coverage, networks, and benefit structures (copays, allowances, discounts) depend entirely on the plan your employer has chosen. Enrollment usually occurs during your company's open enrollment period.

- Convenience: Often seamlessly integrated with your overall benefits package, making enrollment and premium deductions straightforward.

- Best For: Most working individuals who have access to this benefit. It's often the most cost-effective way to get vision coverage.

4. Standalone Individual Vision Plans

If you don't receive vision coverage through your job, or if you're self-employed, retired, or simply seeking additional coverage, you can purchase an individual vision plan directly from an insurance provider.

- How They Work: You pay the full premium yourself. These plans allow you to tailor coverage to your personal needs, with various options for allowances, copays, and network breadth. Pricing varies based on the level of benefits chosen.

- Customization: Offers the ability to pick a plan that best suits your vision needs and budget, which can be particularly useful for vision insurance for families with diverse requirements.

- Best For: Individuals who lack employer-sponsored coverage, those who are self-employed, or retirees seeking to maintain access to affordable eye care. It's important to compare different vision insurance plans carefully to find one that offers good value for your money.

Making the Most of Your Vision Insurance

Having vision insurance is just the first step; actively using it wisely ensures you get the maximum value.

1. Review Your Plan Details Annually

Benefit structures, allowances, and network providers can change. Before your annual eye exam or before purchasing new eyewear, always take a moment to consult your plan documents. This helps you understand your current copays, allowances, and any specific exclusions. Knowing these details proactively means no surprises at the checkout counter.

2. Stick to In-Network Providers

Most vision insurance plans are structured to encourage you to use their network of eye care professionals. In-network providers have agreed to specific pricing with the insurance company, meaning your copays and allowances go further, and your out-of-pocket costs are generally lower. While some plans offer out-of-network benefits, they usually come with higher costs or require you to file claims yourself for reimbursement. If you're looking for how to choose the right vision insurance plan for you, ensuring your preferred doctor is in-network is a key consideration.

3. Maximize Your Allowances

Remember that allowances are often "use it or lose it." If your plan provides a $150 allowance for frames each year, try to select frames within that budget. If you choose frames that cost more, you'll pay the difference. The same goes for contact lenses – if you have an allowance, use it to cover as much of your annual supply as possible. Many optical shops will also clearly mark which frames fall within common allowance ranges.

4. Understand Your Lens Options

Standard lenses are usually covered, but specialty lenses and add-ons can significantly increase your costs. Before committing to progressive lenses, anti-reflective coatings, photochromic lenses, or blue light filters, ask your provider for a detailed breakdown of what your insurance covers and what your out-of-pocket cost will be for each option. Sometimes, the added cost is worth the benefit, but it's important to make an informed decision.

5. Plan Ahead for Major Purchases

If you know you'll need new glasses, contacts, and perhaps even prescription sunglasses, plan your purchases to align with your benefit year. Some plans allow you to get an eye exam at one point in the year and then purchase eyewear later, as long as it's within the same benefit period. Check your plan's specific rules regarding when benefits reset.

Common Questions and Misconceptions

Let's address some frequently asked questions and clarify a few common misunderstandings about vision insurance.

Q: Is there a waiting period before I can use my vision benefits?

A: Sometimes, yes. Especially with individual plans, there might be a waiting period (e.g., 30 days, 60 days, or even six months) before you can use certain benefits, particularly for eyewear. Eye exams are often covered sooner. Always check the policy details.

Q: Can I get both glasses and contact lenses in the same year?

A: Most plans require you to choose between using your eyewear allowance for either glasses or contact lenses within a benefit year. Some premium plans might offer separate allowances or significant discounts for both, but it's not the norm.

Q: What if I don't need new glasses every year? Is vision insurance still worth it?

A: This depends on your plan's cost and your usage. If you have a plan that covers an exam every year but only allows new frames every two years, and you rarely change your prescription, the value might be less. However, the routine eye exam alone can be worth the premium, as it helps detect serious health issues early. Weigh the annual premium against the cost of an exam and what you anticipate spending out-of-pocket.

Q: Does vision insurance cover LASIK or other laser eye surgeries?

A: Typically, no. Full coverage for LASIK is very rare. However, many vision plans offer discounts on laser vision correction procedures when performed by participating providers. These discounts can still amount to significant savings, so it's worth checking if you're considering surgery.

Q: My child needs glasses frequently. Is there a plan for that?

A: Yes, many plans are well-suited for families with growing children who might frequently need updated prescriptions and new frames. Some plans offer enhanced benefits for children, or you might find a standalone individual plan that prioritizes higher allowances or more frequent eyewear benefits.

Is Vision Insurance the Right Fit for Your Vision Needs?

Understanding what is vision insurance and how it works empowers you to make an informed choice. For many, it's a valuable tool for managing healthcare costs, especially for those who wear glasses or contact lenses, or simply prioritize annual preventative eye care.

If you regularly visit the optometrist, update your glasses or contacts, or have family members who do, the benefits of vision insurance—from covered exams to allowances and discounts on eyewear—can quickly outweigh the monthly premiums. For others with minimal vision needs or those who prefer ultra-affordable eyewear options, a discount plan might offer a more cost-effective solution.

Ultimately, the best approach is proactive planning. Don't wait until you're staring at an unexpected bill. Take the time to assess your current vision needs, consider your budget, and then explore the various plan types available to you. Your eyes are priceless, and ensuring they receive the care they need is an investment that truly pays off in the clarity of your world.